The MRV objective. What is the Carbon Market and how it Works?

For many people involved with shipping, the Carbon Market concept may not be so clear, despite being in place for quite some years for shore industries. With the advent of the MRV the carbon market tools were put in place, delivering to the administrations and EU the required information to define the called “Cap”.

Carbon trading, sometimes called emissions trading, is a market-based tool to limit GHG. The carbon market trades emissions under cap-and-trade schemes or with credits that pay for or offset GHG reductions.

Cap-and-trade schemes are the most popular way to regulate carbon dioxide (CO2) and other emissions. The scheme’s governing body begins by setting a cap on allowable emissions. It then distributes or auctions off emissions allowances that total the cap. Companies that do not have enough allowances to cover their emissions must either make reductions (becoming more energy efficient) or buy another companies’ spare credits. Members with extra allowances (the efficient companies) can sell them or bank them for future use. Cap-and-trade schemes can be either mandatory or voluntary.

A successful cap-and-trade scheme relies on a strict but feasible cap that decreases emissions over time. If the cap is set too high, an excess of emissions will enter the atmosphere and the scheme will have no effect on the environment. A high cap can also drive down the value of allowances, causing losses in firms that have reduced their emissions and banked credits. If the cap is set too low, allowances are scarce and overpriced. Some cap and trade schemes have safety valves to keep the value of allowances within a certain range. If the price of allowances gets too high, the scheme’s governing body will release additional credits to stabilize the price. The price of allowances is usually a function of supply and demand.

Credits are similar to carbon offsets except that they’re often used in conjunction with cap-and-trade schemes. While shore industry companies that wish to reduce below target may fund pre-approved emissions reduction projects at other sites or even in other countries, shipping companies need to keep their vessels at high energy performance and investing on energy saving projects on the existing ones.

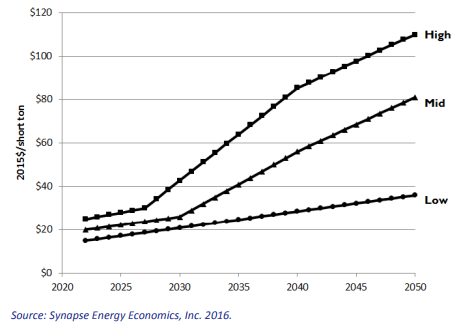

Considering that the average energy efficiency of most feeder container vessels is just about 30%, there is much to do, to make a better use of the fuel, that will be declared and Verified at the end of each year. It is good to remember, that while the cost of an extra Ton of CO2 today is about 6€, the worst scenario indicates values by 2025 well above 80€ per Ton of CO2, but it is also important to consider that for each Ton of Fuel burnt 3.2 Ton of CO2 is emitted. So, for each Ton of fuel saved, you save the fuel cost and the cost of 3.2 Ton of CO2.

Energy saving strategies should start with a proper energy audit a diagnosis, followed by the identification of energy saving actions at machinery level as well as at the ship operation and awareness. The strategy to follow has been put in place by some companies, and it is based on the implementation of ISO 50001.